File Cabinet Locking System Validation,Open Hardware Vs Open Source Hardware 4k,Carpentry Hammer Set - Reviews

Use partitions or other means of protecting and providing privacy for the taxpayer. Ensure that other taxpayers cannot see the contents of the return or other documentation of the taxpayer you are assisting.

TAC employees must take all possible steps to ensure taxpayer privacy and the security of sensitive taxpayer information. For visually impaired employees, a verbal response is acceptable. If a 2D Bar Code Scanner is installed on the workstation, notices that have the social security number masked by the 2D Bar Code may be read using the scanner.

Please refer to IRM 5. After use of all sensitive documents that do not belong with the taxpayer, properly dispose of the materials in an office container specified for classified waste. For additional guidance, see IRM Taxpayers have the right to confidentiality, which means that taxpayers have the right to expect that any information they provide to the IRS will not be disclosed unless authorized by the taxpayer or by law.

Taxpayers have the right to expect the IRS to investigate and take appropriate action against its employees, return preparers, and others who wrongfully use or disclose taxpayer return information. Taking the above steps properly observes and protects the taxpayers' right to confidentiality. If during the conversation with the taxpayer or their representative, there is a request to speak with the manager, advise the taxpayer you will contact the manager for additional assistance.

If the manager is not located in the TAC, ask the taxpayer to please wait while you make contact with the manager. Your primary role is to provide taxpayers top quality service by helping them understand and meet their tax responsibilities.

If your office does not have an IAR, then periodic announcements regarding self-service, such as the location of forms, should be made to minimize wait time. If you see a taxpayer having difficulty reaching or finding a form or opening a door, offer to help. If the taxpayer has business with a specific IRS employee, such as an audit appointment or has a case assigned to a revenue officer, refer to your office phone directory, Discovery Directory or other resources as necessary.

Never leave the office without proper coverage. If you must step away from the counter, have a system in place e. Taxpayers are protected from discrimination. Federal Protective Service FPS policy reflects that civil rights laws may mandate the allowance of certain items into federal government buildings.

If a taxpayer or their representative complains that their civil rights were violated, a signed complaint may be filed with the Civil Rights Division CRD. See Taxpayer Civil Rights. The primary purpose of these local numbers is to provide the public with a means of accessing the local IRS office to learn the office location and available services.

Callers are greeted with a recorded script. The script provides the TAC address and toll-free number to make an appointment. Telephone numbers are published for every TAC, except for cities that have multiple offices. At least two TAC telephone numbers are published to give coverage throughout the metropolitan area.

Telephone numbers for offices for which there is no TAC located within an area code are also published. These offices are defined as PODs. Taxpayers with disabilities face unique challenges when attempting to meet their tax obligations. The Americans with Disabilities Act ADA also prohibits discrimination based on disability in employment, state and local government, public accommodations, commercial facilities, transportation and telecommunications.

See the ADA website for more information. Also, review the Taxpayer Accommodation Guide for general guidance on providing reasonable accommodations. In the event that a requested accommodation cannot be provided, communicate with the taxpayer to identify an alternative, effective accommodation.

If necessary, work with your manager to provide the reasonable accommodation, or contact the Civil Rights Unit for guidance at or via e-mail at edi. The purpose of this IRM section is to provide TAC employees with the necessary tools and information to better assist taxpayers with disabilities.

If a taxpayer requests a sign language interpreter, there are procedures in place and an appointment must be arranged accordingly. Managers need to coordinate with their territory consumer scheduler to schedule an ASL interpreter. Interpreter requests should be scheduled at least five business days in advance of the taxpayer appointment.

Confirm the taxpayer appointment with the interpreter as soon as possible or at a minimum of twenty-four 24 hours prior to the assignment. However, the taxpayer may elect to return with their own qualified interpreter. They include:. Calling toll-free at , for assistance with tax law and account inquiries. Federal or state relay services. Additionally, taxpayers may call for hardcopy Braille or large print products. Pub , Tax Highlights for Persons with Disabilities, and Pub , Living and Working with Disabilities, may have additional information for these individuals.

When taxpayers who are blind or visually impaired visit TACs, they can usually tell you what type of assistance they need. The challenge is to resolve the issues while being sensitive to the visual limitations. When these taxpayers visit TACs unaccompanied, TAC employees will acknowledge the taxpayers, determine what services they need, and assist them with obtaining Queuing Management System Qmatic tickets.

TAC employees will advise taxpayers who may not be able to read the Contact Recording signs, that their contacts are being recorded. If these taxpayers choose to opt-out of having their contacts recorded, employees follow Qmatic procedures.

Taxpayers with visual or motor skill limitations may ask for assistance in completing paperwork or writing a check. TAC employees will assist in this area, as needed, and ensure the taxpayer is aware of what is being written. Taxpayers can be expected to sign on their own behalf and should let the TAC employee know of methods that would be helpful in executing the signature.

Each taxpayer will need varying degrees of assistance based on their individual needs. Elderly Taxpayers — Listen completely before responding to elderly taxpayers, however control the conversation to stay in scope. Do not assume the taxpayer does not understand their tax situation. Illiteracy — Although not a disability, Illiteracy may be considered a limitation.

Generally, non-reading taxpayers will not volunteer this information, but instead may ask you what their notice or form says. If these taxpayers ask you to read or explain something, do so willingly and without question.

Multilingual services are offered to taxpayers with a language barrier. It is impossible to know the proper response to every situation involving individuals who are disabled just as it is impossible to know every appropriate way to interact with non-disabled persons. Remember the individual with a disability is first a person and should be treated as such.

The following are some points to keep in mind when assisting taxpayers with disabilities:. Speak in moderate tones. Always talk directly to the person who is disabled regardless of the disability or if there is someone else present to assist the person.

It is not necessary to talk louder than normal unless you are asked to do so. Long periods of quiet may make the taxpayer wonder if you are still assisting them. If you need to leave the desk for any reason, let the taxpayer know that you are leaving and let the taxpayer know when you return. Do not finish sentences or fill in words. This could be taken as demeaning.

Refrain from making remarks like "slow down" , "take a breath" , or "relax". This can be taken as patronizing. Use a relaxed and moderate rate of speech. The purpose of AMC is to provide alternative media resources to IRS employees and external customers with disabilities and to exemplify the spirit of the laws designed to enhance access to government information by people with disabilities.

The AMC has made alternative formats available through the same channels as printed products for both internal and external taxpayers. Orders for alternative formats already available are shipped within 72 hours; all other requests take weeks to process.

EST at or by email altmc irs. Under Section of the Rehabilitation Act of , persons with disabilities accompanied by service animals must be allowed building entry and access to Taxpayer Assistance Centers. Service animals are defined as dogs or other animals that are individually trained to do work or perform tasks to assist people with disabilities.

The following are guidelines for service animals at TACs:. When it is not obvious what service an animal provides, only limited inquiries are allowed. If necessary, staff may ask if the animal is a service animal that is required because of a disability and what service or task the animal is trained to perform.

Allergies and fear of animals are not valid reasons for denying access or refusing service to people using service animals. People with disabilities who use service animals cannot be isolated from other patrons or treated less favorably than other patrons. This section is your guide to providing quality taxpayer contacts. Effective communication is essential to promoting voluntary compliance; therefore, TAC employees must always:.

Wear a name tag displaying their name while providing face-to-face assistance to taxpayers. If the name tag has not been ordered and received, the employee must verbally identify themselves by providing their name and employee identification number all 10 digits of their Personal Identification Number to all taxpayers.

Offer a survey card per IRM Secure the necessary facts. Use a purpose statement, when appropriate, to prepare the taxpayer for a series of questions. Control the conversation, avoid extraneous dialog and use talk time that is appropriate to the issue. Apologize if the IRS has made an error or created an unnecessary delay. Verify disclosure account contacts only and follow the guidelines in IRM Use up-to-date reference materials to stay informed of changes.

The most up-to date materials are found on SERP. The employee will advise the taxpayer that:. The completed card should be placed in the survey card drop box, or when appropriate, the TAC employee can accept the card and place it into the drop box. If a taxpayer questions why they are not offered a card, the employee will advise the taxpayer that the survey is being offered to taxpayers through a random sample.

At each TAC, a designated employee or manager ensures the completed survey cards are always secured. Twice a month, the designated employee or manager:. The designated TAC manager is responsible for mailing the cards to the vendor. Two shipments per month are required, one between the 1st and the 15th day of the month and the second between the 16th and the end of the month.

The shipments may be made anytime during each of these periods, but the shipments must be recorded on the CSS Tally by the 15th day of the month for the first shipment and by the last day of the month for the second shipment. The designated employee or manager:. Enters the number of cards in the shipment in the appropriate mid-month or end of month cell for the TAC. Ensures no cells are left blank. A zero entry is required if zero cards were shipped due to none being received or because an office was closed.

Enters comments if zero cards are recorded for a month or longer period explaining why no cards were received. Minors may not act as interpreters, even if they are family members.

Interpreters can be reached by dialing the access telephone number If there is a hold time, wait a reasonable amount of time at least 5 minutes prior to ending the call. If the problem persists contact your area OPI analyst to report, along with other concerns e. Advise the taxpayer that the appointment can be re-scheduled for a time when the service is available the service provider advises when the requested service is available.

If the taxpayer does not want to wait for agency-provided interpreter services and wants to use their own interpreter, it can be allowed if the employee has first offered to provide a qualified interpreter to the taxpayer at no cost. Each TAC employee must use their own unique personal identification number. Your PIN must not be shared. The interpreters are not employees of IRS, therefore, TAC employees should communicate with the interpreter exactly as you would advise the taxpayer and only disclose taxpayer information that is necessary to resolve the issue.

Care should be taken to use the service efficiently, including, termination of the call while performing case research, and calling back when research is completed. Document one call per form. The specific information allows the contractor to conduct proper research regarding any issue.

The OPI contract provides interpretive services via phone for agency face-to-face and telephonic contacts with taxpayers. Do not send inquiries to the vendor for written translations. The goal is to record all calls made to OPI during the month so that usage can be reconciled against the vendors invoice.

All other signs or handouts displayed or distributed in the TACs e. TACs must display the latest revision of Required Signs. Outdated signs must be removed when a new revision is received or the end of the initiative being publicized. The following list contains signs from other business units approved for indefinite posting by the DFA:.

Managers will also ensure brochures are available for distribution to taxpayers. Hand the taxpayer the numeric keypad and request input of their TIN. Once TIN is input, the employee inputs additional required information e.

Follow procedures in IRM Corporate officers or duly authorized agents may sign any of the following forms by facsimile e. Officers or agents using a facsimile means of signature must retain a letter, signed by the officer or agent authorized to sign the return, declaring under penalties of perjury that the facsimile signature on the form is the signature adopted by the officer or agent and that the facsimile signature was affixed to the form by the officer or agent or at his or her direction.

The letter must list each return by name and identifying number. The letter shall be maintained for at least four 4 years after the due date of the tax that relates to the tax return, or the date the tax is paid, whichever is later. See Rev. Acknowledgement of faxes by a return fax that are received in the course of tax administration activities is normally not done.

Exceptions can be made in unusual circumstances. When available, EEFax must be used in lieu of manual faxing. See the Clarification of Policy for Use of Fax in Taxpayer Submissions clarifying the term "faxed signature" in regards to IRS policy on accepting taxpayer submissions by fax.

Employee plan and exempt organization determination letter applications are not accepted via fax. Determination letter requests related to income tax, gift tax, estate tax, generation-skipping transfer tax, employment tax and excise tax matters are not accepted via fax. Area quality analysts have access to reviews and share them with the field to inform of quality improvement efforts. The results of the national review cannot be used to evaluate any individual employee's performance.

There are five quality measures used to assess FA performance:. The other measures are internal to IRS and used for diagnostic and performance improvement in the customer accuracy measure.

Your office should be safe and secure. This applies to both the taxpayer waiting area and your work area. If you notice outlets, cords, chairs, or office fixtures in need of repair or replacement, notify your manager or the Commissioner's Representative CR in your Post of Duty POD to ensure necessary repairs are made.

The online OS Get Services is available to report problems with lights, water leaks or other noticeable repairs needed. You should have direct numbers for the local office of the Treasury Inspector General for Tax Administration TIGTA , your manager, the CR, Criminal Investigation CI if present at your location , the local physical security representative, local guards where applicable, local police, building manager or other facilities support, fire department and other necessary numbers readily available.

Keep Form , Bomb Threat Card at each desk and counter. If you are responsible for opening packages, refer to IRM For procedures on reporting a missing child, see IRM 1. The workplace includes federal facilities, telework locations, alternate worksites and locations where IRS employees conduct official business.

As outlined by the Interagency Security Committee, an act of workplace violence generally can be categorized as one of four types:. Criminal Intent: The perpetrator has no legitimate relationship to the agency or its employees and is usually committing a separate crime such as robbery, in conjunction with the violence. This category includes customers, clients, and any other group for which the agency provides services. Employee-on-Employee: The perpetrator is a current or former agency employee who attacks or threatens another current or former employee s in the workplace.

Personal Relationship: The perpetrator usually does not have a relationship with the agency but has a personal relationship with an agency employee. Possession of weapons of any kind on agency property, including parking lots, other exterior agency premises or while engaged in agency activities in other locations or at agency-sponsored events, unless such possession or use is a requirement of the job.

Loud, disruptive or angry behavior or language that is clearly not part of the typical work environment. A threat is defined as the intention to inflict harm. An assault is defined as an attack by action or by word. You are sometimes the focal point for the anger, fear, frustration or other emotional outbursts of a taxpayer.

If you fear for your safety, take immediate action to protect yourself. Threats or assaults do not have to be directed toward you for you to take action.

If a taxpayer is threatening your family, your co-workers or any other government employee, try to obtain the following information:. Ask the taxpayer to leave.

If you discover that your duress alarm is inoperable or missing, it is imperative that you notify your manager immediately. If no help is available on site, contact your local law enforcement agency Federal Protection Service, police, sheriff, or state patrol in an emergency situation. If you must contact a local law enforcement agency, inform the agency that you have been threatened while performing official duties. Disclose ONLY the name and address of the location where the threat occurred.

Contact the Disclosure Help Desk before releasing confidential tax information to the local law enforcement agency. Report every incident, no matter how insignificant it may appear on the surface. TACs should be treated as a controlled access environment at all times. Controlled access is an essential aspect of ensuring that FA has adequate safeguards in place to protect taxpayers' information from disclosure and prevent unauthorized access to both information and property.

In determining the security criteria for TACs, consideration should be given to the types and volumes of assets regularly received and stored. Examples of such assets include, but are not limited to, cash remittances, Form receipts, "Proof of Delivery" , "Received" , and "Received with Remittance" stamps, tax returns, and return information.

Allow access to the TAC to employees from any organizational unit impacted by hurricanes or natural disasters. Limit their access to what is necessary. All TAC managers and employees should keep in mind that "The basic principle of security within IRS or anywhere is to limit access to assets based upon need. The Form coding guide is to be used to ensure standardization of time reporting for all TACs.

TAC employees and backup employees details-in must accurately report the number of taxpayers assisted, the amount of time spent and the type of inquiry the one that took the longest amount of time. It is important that FA employees do not close out their contact on Qmatic until all actions have been taken for a particular taxpayer to ensure all time spent is accurately captured.

Do not attempt to enter this information into Qmatic. Form is required to be kept for two 2 months if prepared during filing season and for one 1 month if prepared during non-filing season. Form , Walk-In Contact Card, may be used as a traffic management tool in the event the Qmatic Ticketing system is not operational refer to the instructions on the back of the form on how to use.

If necessary make any changes and manually enter direct activity not reported through Qmatic and enter all Overhead activity. Monday, following the end of the workweek. All employees assigned or detailed to FA are required to use FAMIS for capturing and reporting daily work units and hours for services provided and other work performed:.

Accuracy is critical. Review your math carefully. Employees capture virtual taxpayer assistance under a separate ODN. This allows employees to capture units where taxpayers are seeking service.

Employees must report data consistently in order to have accuracy when analyzing the data. Therefore, the following procedures are for all employees who work at a VSD support site:. Remittance Policy. This section outlines functional remittance policy that is the general framework for procedures. Public trust and integrity. The public can trust that IRS remittance processing operations are timely, accurate and conducted with the highest integrity.

Functional remittance policy is in accordance with law governing money and finance and standards for internal control in the federal government. The IRS is committed to a 24 hour deposit standard for tax payments collected. The standard is for the remittances collected in field offices to be processed on the day or receipt or by the next business day. The 24 hour deposit standard is met by scanning and key verifying the paper check and submitting it for deposit no later than the first business day after the date of receipt of the check.

Pursuant to 26 U. Employees are responsible for protecting and safeguarding monies that they have collected. In the event that an employee loses or fails to account for and pay over the money collected, an assessment for the loss may be made against the responsible employee and shall be collected from the employee as if it were a tax. This is in addition to any disciplinary action taken against the employee.

Payment drop boxes. Payment drop boxes are not authorized to be present, or used, in TACs for any purpose. Alternative methods of making payments.

Advise taxpayers of alternative methods to make payments. Please refer to IRM Offer Pub , Need to Make a Payment?

Acceptable remittances. TACs only accept standard forms of payment from taxpayers, such as checks, money orders, and cash. Unacceptable remittances are items that the Federal Reserve Bank do not accept as payments. All legal United States tender is acceptable for payment of taxes.

For further guidance, refer to IRM 3. Refer to IRS. Certain payments presented at a TAC may vary from normal remittance processing procedures. All payments. If the taxpayer does not provide specific written instructions to apply a non-IA payment, the IRS applies the payment to tax periods in the order of priority that the IRS determines will serve its best interest.

The payment is applied to satisfy the liability for successive periods in descending order of priority until the payment is absorbed. Overages are generally be applied to the earliest period. Per IRM 5. Applying the payment. Take special care when processing payments to ensure that the correct amount is applied to the correct account, so that the money does not erroneously refund to the taxpayer. Posting document. If the taxpayer does not have a tax form, notice tear-off, or payment voucher, a posting document must be prepared e.

Third party payments. In the case of a third party who demonstrates the willingness and means to pay:. If the third party does not intend to full pay the account, the balance cannot be disclosed to the third party.

All payments must be recorded on Form A, Remittance and Return Report, as part of the contact prior to closing the contact through QMatic. At the end of the workday, reconcile all payments and posting documents with the payment information listed on Form A before submitting for review or forwarding to the SPC. Form , Receipt for Payment of Taxes, is the only authorized receipt for payment of taxes, fees and ACA payment and is provided to every taxpayer for cash and other types of payments upon request.

Proof of payment. If a taxpayer does not request an official receipt, refer to IRM Some taxpayers may insist on receiving proof that their non-cash payment was delivered to our office. Stamp a photocopy of the taxpayer's check or money order with this stamp as proof of delivery, ONLY if the taxpayer makes such a request. Official receipts. If a taxpayer insists on getting a receipt, issue Form , Receipt for Payment of Taxes.

Form is the ONLY official receipt. When Form is issued, it serves as the posting document unless the payment is received with a return. Form receipts are required for all cash payments and is provided for non-cash payments upon request. TAC with approved Form cash deviation. If the taxpayer insists on receiving an official receipt for a non-cash payment and the TAC is not required to have a Form receipt book:. Call that location in advance to make sure the Form receipt book holder is in the office before sending the taxpayer to another location.

The metal cash box must be secured at all times in a locked metal container. Single large cash payment must be store inside deposit tamper evident bank deposit bag s in the safe until the money is picked up by the courier. Non-cash remittance and documents with PII information must be secured in a lockable metal container.

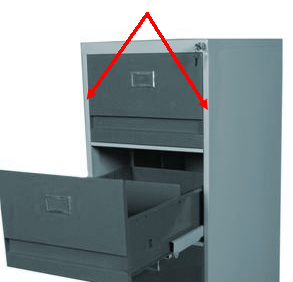

All non-cash remittances not processed using RS-PCC or transshipped must be stored overnight in the safe. The safe must be locked at all times when not in use. Keys are required to be secured at all times. Pelican drawers or overhead file cabinets are not acceptable lockable metal containers in which to store the metal cash box, remittances or documents containing PII data. The lockable metal container must be locked at all times.

Storing personal belongings. Employees are prohibited from storing personal belongings with any taxpayer related documents. Personal items and taxpayer related documents including payments must NOT be stored in the same container. Remittances and documents containing PII. Packages, envelopes with remittances or documents containing PII data must be kept in a locked metal container. Verifying payment information. All payee lines must be over-stamped with "United States Treasury" except for the following:.

If the check or money order is made payable to the taxpayer, the taxpayer must endorse the check or money order. If the taxpayer is not available to endorse the check or money order, the check or money order must be returned to the taxpayer. Payment date. Do not accept checks that are post-dated or stale dated. Definition can be found in IRM 3. If a check date is left blank, contact the taxpayer, ask to return to the TAC to complete the date or get approval to enter the date.

With approval enter the date and your initials. Numeric dollar amount on payment. Verify all money amounts on checks and money orders. There may be instances when the money amount to use is questionable. Authorized signature on payment. Verify that an authorized signature appears on the check or money order. If the remittance is unsigned, and the taxpayer is not available to sign the check or money order, the unsigned check should be submitted for processing.

Additional information. Whenever possible, encourage the taxpayer to include the following additional information on the check or money order:. Clarify and correct any discrepancies with the taxpayer present and inform them that the cancelled check or money order is their receipt and proof of payment.

Negotiable remittance. If a remittance is received that is endorsed by the payee in such a manner that it is negotiable, it must be restrictively endorsed immediately below the last endorsement by writing or stamping "For Deposit Only - United States Treasury". A check made payable to a third party may be accepted if the third party has endorsed the check over to the taxpayer and the taxpayer has endorsed it. Frivolous Check. If a financial instrument or check is received with the characteristics of a frivolous check, see IRM 3.

Replacement check. A taxpayer may be required to provide a replacement check or money order because the original payment was lost in transmission.

Replacement checks or money orders received must be processed with the received date as the posting date. Adjustment and referral procedures must be followed to ensure the taxpayer is not harmed with additional assessments because of the posting of the replacement check or money order. Prepare a referral using Form , Inquiry Referral, for follow-up after the payment posts to abate the excess amount.

Acceptable posting documents. The following can be used as posting documents for checks or money orders secured. A copy of front page of the tax return or the form can be used as a posting document IF another valid posting document was not provided. Form , Payment Posting Voucher. Form , Receipt for Payment of Taxes. When using pre-printed documents i.

If the amount of the payment is different from the amount shown on the posting document, line through the incorrect amount and handwrite the correct dollar amount on the posting document. This includes the pre-printed payment amount coded on the bottom of a notice. Do not use white-out to make corrections. If you receive a notice tear-off with a non-cash payment, write the DPC and circle it when applicable.

If the non-cash payment is received without a pre-printed posting document or tax return, prepare Form , Payment Posting Voucher through AMS. Apply payment to module s with the earliest CSED, unless taxpayer specifies a particular tax year.

Refer to Exhibit Stamp all posting documents, except Form and Form , with an official "Received with Remittance" stamp. Place the stamp on the front of the document. If your office does not have a remittance stamp, use your "Received" stamp and write "With Remittance" in ink.

Payments transmitted to SPC without a date stamp or properly completed posting document are posted as of the date the payment is dated. This could create a late payment and result in the issuance of Form , Teller's Error Advice, to the employee submitting the payment. The TC is a three-digit number that identifies a transaction being processed.

Secondary TC. When preparing payment posting documents other than Form , designate the following payments with TC and the appropriate Designated Payment Codes DPC and secondary transaction codes where appropriate :.

Payments received with Form X, Amended U. This includes posting subsequent payments when an installment agreement is paid off by the fraudulent refund claimed by the identity thief. Facilitate identification of payments which are designated to trust fund or non trust fund employment taxes.

Indicate application of payments to a specific liability when the civil penalty contains both a Trust Fund Recovery penalty and any other type of civil penalty. In these cases, they are input to MFT 55 only.

Identify the event which resulted in a payment. This is done at the time that a payment is processed and may be used with any MFT to which the payment transaction will post.

Data from this type of input is accumulated on a national basis to determine the revenue effectiveness of specific collection activities. The design, manufacture or installation of a protective structure is deemed to be in compliance with the standard if it has been certified, signed and sealed by an engineer. This section does not apply to graders or loaders used for snow removal if these vehicles only circulate in places where there is no risk of overturning.

Nor does it apply to a low profile agricultural tractor when used in an orchard. The plate shall be permanently attached and the inscriptions thereupon shall be legible at all times. The distance between the pile and the sprinkler shall not be less than mm. Assistants can help the shot-firer in his work, with the exception of setting off the blast which shall be done by the shot-firer himself. The shot-firer shall supervise and co-ordinate the work of his assistants.

The Commission can also cancel or suspend, for a period of from 3 to 24 months, the certificate of a shot-firer when the work he does is the subject of a remedial order under section of the Act respecting occupational health and safety or of an order under section of that Act, by reason that he refused to comply with the Act or this Regulation.

The information referred to in subparagraph 1 of the first paragraph shall be collected by a qualified person. The precautionary measures referred to in subparagraph 2 of the first paragraph shall be drafted by a qualified person and implemented.

If it proves impossible by ventilating the enclosed area to maintain an internal atmosphere in compliance with the standards provided under subparagraphs 1 and 3 of the first paragraph, a worker may only enter or be present in this area if he wears the respiratory protective equipment specified in section 45 and if the internal atmosphere of this enclosed area complies with subparagraph 2 of the first paragraph.

These measures include training devised by a qualified person and dealing with methods and techniques that shall be employed by the worker to carry out his work safely in this enclosed area. They can also provide, where necessary, for the use of equipment that is appropriate for this type of work as well as the other personal and collective protective means and equipment that the worker must use.

The readings shall be taken in such a manner as to obtain an accuracy equivalent to that obtained following the methods described in section 44 or, when these measures cannot be applied, by following another recognized method. However, in the case where the readings are made using continuous reading instruments equipped with alarms that sound when the air quality does not meet the standards set out in subparagraphs 1 to 3 of the first paragraph of section , the readings shall only be recorded in the register if the alarm goes off.

Only those entries in the register that do not comply with the standards set out in subparagraphs 1 to 2 of the first paragraph of section shall be kept for a period of at least 5 years. The person responsible for the supervision shall remain outside the enclosed area. Such a procedure shall be implemented as soon as any situation so requires. This procedure shall provide for the necessary rescue equipment.

It may also make provision for a team of rescuers, an evacuation plan, alarm and communications devices, personal protective equipment, safety harnesses, lifelines, a first aid kit with emergency equipment as well as recovery equipment.

However, this Division does not apply to the teaching and practice of recreational diving that are governed by the Act respecting safety in sports chapter S In a scientific dive performed by a government agency, educational institution, non-profit research institution or any other non-profit institution, the employer must comply with the provisions of this Division or the Canadian Association for Underwater Science Standard of Practice for Scientific Diving, 3rd Edition, October Subject to sections In addition, the dive team includes 2 hyperbaric chamber operators when such a chamber is required.

Subparagraph 2 and the second paragraph also apply in the case of police diving. Section A scuba diver may not act as a standby diver for a surface-supplied diver. The duties performed on the surface in relation to diving operations must be assumed by workers who are not members of the dive team.

The lifeline must 1 be made of cord a of material other than natural fibre or monofilament polypropylene;. An umbilical may be used as a lifeline if it was designed for that purpose. If not, a lifeline must be integrated to protect the umbilical against any tension. If the lifeline of the accompanying diver could also get stuck or tangled, the diving supervisor may authorize the 2 divers to buddy dive in accordance with section Except in case of emergency, a diver must never be in a situation of undue exposure defined in those tables.

During a dive to a depth of more than 50 m, the 2-way voice communication between the diver and the surface must be recorded for the entire dive. The recording must be kept for at least 48 hours. A dive must be interrupted if the 2-way voice communication system should fail. When a diver is in the water, no boat or other floating equipment in the work area may be moved without the authorization of the diving supervisor.

If it is impossible to use a deflector, another means ensuring equivalent safety must be approved by an engineer. In addition, the lead wire must not be attached to the detonator before all divers have moved at least m away from the explosion site on the water or have taken shelter on shore. Those devices, equipment and tools must be 1 insulated;. The logbook must be retained by the employer for at least 5 years.

In addition, the diver must enter the following information in the logbook after each dive: 1 the name of the employer for which the dive was performed;. Water supplying a heating or cooling unit must not come from a contaminated environment. A diver must wear a wet suit under the diving suit in the cases referred to in subparagraphs 1 and 2 of the second paragraph.

The stage must 1 be built to prevent tipping or spinning;. If the stage is a cage, submersible compression chamber, platform or diving bell, it must meet, in addition to the requirements referred to in the second paragraph, the requirements referred to in paragraph 3 of section 3.

If the entry point into the water is 2 m or less from the water surface and there is no stage, a ladder must be available to the divers. The drawings of the means must be prepared by an engineer and available at the diving station. The crane, boom truck or device referred to in the first paragraph must be available at all times to move divers. The crane, boom truck or device may not be used for other purposes while divers are still in the water.

Only dive team members may give instructions to the operator of the crane, boom truck or device referred to in the first paragraph. Gases and gas mixtures may not have particles exceeding 0.

The employer must keep the maintenance record set up under Clause 6. The system must include the following components: 1 a main supply capable of supplying the required quantity of breathing mixture for the entire dive;. Each component of the supply system must operate independently. An interruption of the main supply must not prevent supply from the auxiliary reserve or the emergency self-contained breathing apparatus.

The diving supervisor may also require that a diver again undergo the physical examination referred to in the first paragraph and obtain a new medical certificate, if the supervisor considers that the diver is unfit to dive safely. Before diving again, the diver must obtain a medical report attesting that the diver is fit to dive.

They must be kept in good condition. No diver may accompany the victim of a diving accident in a hyperbaric chamber if the diver is not medically capable of being pressurized or has dived within the last 18 hours. A diver who accompanies the victim of a diving accident in a hyperbaric chamber may not dive within 24 hours after coming out of the chamber. Likewise, the measures apply if sediments containing contaminants are moved with equipment resulting in their suspension at the underwater workstation.

If the concentration level of contaminants may not be established before the dive, the preventive measures in a contaminated environment in sections The limits of each area must be clearly defined and marked and the following instructions must be followed: 1 only workers wearing the required protective clothing and respiratory equipment may enter the exclusion area; and.

The submersible compression chamber referred to in subparagraphs 2 and 3 must comply with CSA Standard Z The standby diver in the submersible compression chamber also acts as tender. The diving operation referred to in the first paragraph may be performed if the employer has agreed with the owner of a hydraulic structure or a hydroelectric plant that measures to control the flow of turbine discharge or discharged water must be planned and implemented before beginning the work and maintained until the work is completed in order to ensure stability in the current at the dive site.

A copy of the agreement must be available at the diving station. In addition, the following safety standards must be complied with: 1 the diver must be lowered underwater so as to progressively go near the area to inspect; and.

If the recipient has already contained such materials, no work involving welding, cutting or heating may be undertaken on the recipient until it has been properly cleaned in order to eliminate any material that is combustible or likely to discharge toxic or inflammable vapours when heated.

If after having cleaned the recipient and made a reading of the concentration of inflammable vapours and gases, there remains a risk of explosion, the work involving welding, cutting or heating may only be performed if one of the following conditions is met: 1 the recipient is filled with water to within a few centimetres of the point of welding, cutting or heating and the remaining space is ventilated to ensure the evacuation of hot air;.

Conduits and connections shall be disconnected, then closed to eliminate the spilling of any material that is combustible or likely to discharge toxic or inflammable vapours when heated.

However, such grounding is not necessary if the tools, appliances or accessories connected to the auxiliary plugs are equipped with double insulation or a third conductor ensuring the continuity of the grounding, or if the branch circuits are protected by Class A ground fault circuit interrupters.

This section does not apply to automated cleaning systems. As such, the floor shall have a 1 to incline and have an opening at the lowest level of the pit to allow for the evacuation of air. Movable walkways equipped with guardrails shall be available and easy to put into place for doing work at the end of a vehicle, where the vehicle is shorter than the pit.

If it is impossible to install a barrier or a warning line, a guardrail around the pit, a cover or a wire fence whose strength complies with that provided for in subparagraph 4 of the first paragraph of section 14 shall be installed to eliminate the risk of falling. Work on a wheel under pressure, including handling and inspection, must be carried out according to trade practice.

The inflating of tires must be done according to trade practice, in particular by using a holding device that prevents the projection of wheel components, such as a cage, support, chain, bar assembly or, in the absence of such device, any other means that ensures the safety of workers.

Note: In a HANA replication setup, for example, if you have a replication system of HANA SID where the first two nodes machine01 and machine 02 are master nodes, and the other two nodes machine03 and machine04 are standby nodes, create the key on all nodes. When the master nodes are down and the standby nodes become the master nodes, the key will still remain valid and can connect to machine03 and machine04 when machine01 and machine02 are not available.

You must create a parameter file when you perform certain types of backups and restores. Users who perform backup operations must be local administrators so that they have full control over the registry folder and the installation folder. User credentials are not set during the agent installation. By default, the local system account is used. You can configure Office applications to back up directly to the Metallic cloud without installing additional hardware or software.

Protect data in the following Office applications from accidental deletions, ransomware scenarios, and data corruption:. When it is time to recover data, you can find and recover as many files as you need, or you can restore an entire folder or mailbox to a point in time. The Subscription Usage tile in the Hub displays the total number of unique users protected from the start of the current month until today. The way unique users are calculated differs for each Office application:.

If a user was protected for one or more days in the month, the user is counted as part of the total user usage. The user is counted even if it is removed from a backup schedule or if backup data was deleted from the system within the same month.

If the user is not backed up in the following months, it is not counted as part of subscription usage for those months. For example, if User 1 and User 2 are protected on the first day of the month, and User 1 is removed from the system later that month, the total number of users protected in the month is two users. If User 1 is not backed up in the following month and User 2 is backed up, the total number of users protected in the month is one user.

The Subscription Usage report lists the names of all the users protected from the start of the current month to today. To perform operations, such as restore operations, on an Office application, you must open the application. To set up Exchange Online, you can use the express configuration option or the custom configuration option. The index server is scanned every 24 hours.

Messages that are eligible for data aging based on their received time and the rules defined in the plans are pruned. To get started with backing up an Exchange Online mailbox, complete the following tasks:.

Before you begin the automated setup and configuration of Office with Metallic, check the following configurations in the Office applications:. Use the express configuration option to create an Exchange Online app.

After you create the Azure app that is needed for the Exchange Online app, the Metallic software automatically creates an Exchange Online service account for the Azure app, syncs the app with Azure, and authorizes the Azure app.

Express Configuration for Exchange Online. The custom configuration method is a manual process that requires the following actions and information:. You can create the Exchange Online client manually by providing the Azure app details and Exchange Online service account login details.

Complete the setup for Modern Authentication :. When you finish creating the client secret, record it. You will need to enter these values when you add an Exchange Online app. To improve performance and to minimize throttling, you can register multiple apps. For example, for an Exchange Online app that has 2, mailboxes, register 5 apps. Every time an additional 1, mailboxes are added, register 1 additional app. Disclaimer: You perform these steps in the Microsoft Azure Active Directory web application, which is subject to change without notice.

In an Office with Exchange environment, you must configure the Exchange Online service account to discover, archive, clean up, and restore data for user mailboxes, group mailboxes, and all public folders. The Office with Exchange Exchange Online administrator account must have the following service accounts configured:.

Modern authentication is a method of identity management that offers more secure user authentication and authorization. You need to enter these values when you add the app to the Metallic software.

For an Exchange Online app that has 5, mailboxes, register 5 apps. The Azure AD application is subject to change without notice. You must configure the Exchange Online service account to discover, archive, clean up, and restore data for user mailboxes, group mailboxes, and all public folders. Add the mailboxes that you want the Exchange Online app to back up to the app. To confirm that the Exchange Online app and mailboxes are set up correctly, perform a test backup and restore.

To discover mailboxes automatically, add the AD group to the Exchange Online app. After you enable automatic discovery on the app, when a backup operation runs for one of the mailboxes, users groups are automatically discovered and included in the backup.

To automatically discover new user accounts, run a backup operation on the autodiscovery-enabled mailboxes. You can restore an individual mailbox item such as folders, messages, and calendar appointments or an entire mailbox. You can restore an individual Exchange Online mailbox item to the location that it was backed up from. You can export folders or messages to an export set, change the format of the items to fit your needs, and download the exported PST or CAB file directly to your browser.

When you export, an export set is automatically created. The size limitation applies to the total size of emails exported from the Office client.

Use the documentation that applies to the version that your environment has. Note: Due to a known issue with Microsoft, the following items cannot be backed up or restored:. To get started with backing up a OneDrive for Business user, complete the following tasks:. Use the express configuration option to create an OneDrive for Business app.

After you create the Azure app that is needed for the OneDrive for Business app, the Metallic software automatically creates an OneDrive for Business service account for the Azure app, syncs the app with Azure, and authorizes the Azure app.

Add the users that you want the OneDrive for Business app to back up to the app. To confirm that the OneDrive for Business app and users are set up correctly, perform a test backup and restore. After you confirm that the OneDrive for Business app and users are set up correctly by performing a test backup and restore, configure your environment. You can create the OneDrive for Business app manually by providing the user details, Azure app details, and service account login details.

You will need to enter these values when you add an OneDrive for Business app. All users that belong to the user groups that you add including users that are automatically added to the user groups are included in backups of the app. You can choose to add all users to a OneDrive for Business app so that all users, including new users that are automatically discovered, are included in backups of the app.

The next time the OneDrive for Business app is backed up, new users are automatically discovered and included in the backup. To discover new users immediately, perform an on-demand backup. Office plans specify how long deleted files and folders are retained in the backup. You can also use Office plans to filter items from backups.

You can delete a user or a user group from a OneDrive for Business app. You can exclude a user or a user group from backups of a OneDrive for Business app. The server plan that you select for the OneDrive for Business app manages scheduled backups. You can also perform on-demand backups of individual users or of all users or users groups at any time. You can restore the OneDrive for Business users and their files to their original location in place , or to a different OneDrive account out of place.

You can restore the files of OneDrive for Business users to their original location in place , or to a different OneDrive account out of place. For more information about the search filters, see Refine Search for Restores. The Search pane groups filtering options together.

The number of search results will vary according to the selected filters. If you signed up for SharePoint after February 26th, and your automated setup includes the Express Configuration option, refer to the SharePoint documentation. To get started with backing up a SharePoint Online site, complete the following tasks:. Use the express configuration option to create a SharePoint Online app.

The Metallic software automatically creates a SharePoint Online service account for the Azure app, and then authorizes the Azure app. With the express configuration option, you use the Office global administrator account. You can use the custom configuration option instead, if you do not want to use the global administrator account.

Note: The added site follows the retention level of the Office plan that you select. To confirm that the SharePoint Online app and sites are set up correctly, perform a test backup and restore.

After you confirm that the SharePoint Online app and sites are set up correctly by performing a test backup and restore, configure your environment. You can create the SharePoint Online app manually by providing the tenant details, Azure app details, and service account login details. For SharePoint Online backups to work in a modern authentication-enabled environment, you must create an Azure AD application and connect it to the tenant.

You must configure the SharePoint Online service account to discover, backup, and restore data for File Cabinet Locking System Verilog SharePoint sites. You can add the following categories to the SharePoint Online app to back them up:. You can exclude a site from backups of a SharePoint Online app.

Excluding a site does not remove that site from the app, but the site is not backed up. The server plan that you select for SharePoint Online manages scheduled backups. You can also perform on-demand backups at any time. You can restore the SharePoint Online site and documents to their original location in place , or to a different OneDrive account out of place.

You can restore the SharePoint Online sites to their original location in place. Note: By default, the existing files and folders are overwritten during the restore operation. You can restore the SharePoint Online documents to their original location in place , or to a different OneDrive account out of place.

You can restore the SharePoint Online documents to their original location. Due to a known issue with Microsoft, the following items cannot be backed up or restored:.

To back up OneDrive user accounts, configure user groups to automatically discover user accounts. The user accounts that are discovered are added to user groups in the OneDrive app. To perform a test backup operation, you can manually create a user group and then manually add a small number of user accounts to your user group.

You can use regular expressions or wildcards to autodiscover user accounts by UPN. The regular expressions that you use are case sensitive. When you use regular expressions or wildcards to autodiscover user accounts, user accounts that match the regular expressions or the wildcard pattern are automatically assigned to the user-defined user group for which you enter the regular expressions or wildcards.

If a user account does not match the expressions, then it is automatically assigned to the default user group. Enable autodiscovery of user accounts, and then select Regex patterns. For more information, see Enabling Autodiscovery of User Accounts.

Run a backup operation on this user-defined user group to back up all the user accounts that have UPN that match the regular expressions or the wildcard patterns that you entered. Enable autodiscovery of user accounts, and then select Azure AD groups. Run a backup operation on this user-defined user group to back up all the user accounts that belong to the Azure affinity groups that you selected.

To perform a test backup operation, manually create a user group and then manually add a small number of user accounts to the user group. After testing is complete, enable autodiscovery to automatically discover user accounts to back up. The custom configuration method is a manual process that requires the following actions:. Review the example that applies to the type of app that you are adding:. You need an Office licensed user account.

The account will be added to the team that is being backed up. To confirm that the Teams app and teams are set up correctly, run a backup operation followed by a restore operation. After you enable autodiscovery, then all teams are added in the subclient and backup operations run on all teams. To automatically discover new user accounts, run a backup operation on the autodiscovery-enabled teams.

The next autodiscovery will discover the removed item, and the item will be added back to the app. Tip: To see items that were removed, on the Content tab, click the gear icon , and then select Clear all filters. The status column is added to the table that displays Active , Deleted , Do not Backup and Unprotected status for the item. Excluding an item does not remove the item from the app, but the item will not be backed up after the next autodiscovery runs.

Tip : To see items that were excluded, on the Content tab, click the gear icon , and then select Clear all filters. You can restore an entire team, a channel, or Teams items such as posts, files, and wikis to the same location or to a different location. For files, in addition to in-place restore operation and out-of-place restore operation, you can also choose to restore to a file location.

Depending on the location for the restore operation, you will see the following results:. For any restore operation of teams, channels, posts, wikis, or files, you can choose the following file options:. You can restore individual items such as post, files, wikis to the same location or to a team or channel in a different location.

You can search for a team or a team item, such as channel, conversation, file, tab, or wiki. Accessing the Metallic by using the URL and user account credentials that you obtained from the administrator. Step 3: Review Salesforce Prerequisites. Step 4: Configure the Salesforce Environment. Step 5: Complete the Salesforce Guided Setup. Configure the Salesforce app by completing the guided setup for Salesforce. For information, see Completing the Salesforce Guided Setup.

Step 6: Back Up Metadata Optional. You can include metadata in the Salesforce backups. For more information, see Backing Up Salesforce Metadata. Step 7: Perform a Backup and Restore. As part of planning the Salesforce installation, review the support information and data protection best practices.

The Metallic software supports production and sandbox organizations, and all products and platforms that support Salesforce APIs, including the Lightning Platform. Verify the Connection to Salesforce. When you perform any of the following operations, click Test Connection to verify that you can connect to Salesforce or the local database:.

Restoring: If you restore the data to a database, or the Salesforce cloud, and you changed data during the full backup, then you might need to restore additional incremental jobs so that you minimize data inconsistencies. Calculate the percentage of API calls needed for backup operations, and if needed, adjust the percentage. You can follow a guided setup for Salesforce backup.

Use the setup to provision storage and to enter your Salesforce connection details. In Salesforce, verify that you have the required access and create a connected app to integrate with Salesforce. Verify that you can access the Salesforce account and that you have the required Salesforce user permissions. Best practice: To ensure that all data is backed up and restored, create a backup set for one Salesforce user account that has a System Administrator profile or an equivalent profile.

The Salesforce users who perform the backup operations must have the correct permissions set in their Salesforce user profiles. The Salesforce users who perform certain types of restore operations must have the correct permissions set in their Salesforce user profiles.

You will enter those values when you add the Salesforce organization to the Metallic software. In the Metallic software, add a Salesforce app and if needed, configure additional options such as backing up Salesforce metadata.

Add an app so that you can perform backup and restore operations on your Salesforce data. Use Salesforce data masking to change sensitive information when restoring production data to a sandbox.

Salesforce data masking is useful when you are populating or refreshing a sandbox for development or test purposes. With data masking, you can use realistic production data without exposing sensitive information.

The Metallic software applies the data-masking policies when you run a restore operation. You can apply data masking to sensitive data in objects that you are restoring to a destination sandbox. The Metallic software provides different data-masking strategies based on the data type that you want to mask. For more information about the data types, see the Salesforce documentation in Salesforce Object Basics and its subsections. You can create a data masking policy for Salesforce data.

A data-masking policy contains a set of Salesforce objects and fields to mask and the masking strategy to use to mask the data. The data masking strategies depend on the data type. For easier management, use separate data-masking policies for each backup set. Caution: The changes that data masking makes to the data are irreversible and might destroy the data. Data masking is intended for restoring production data to a sandbox.

Data Masking Strategies for Data Types. The Metallic software provides a dictionary for each data type that supports dictionary data masking. In a Linux environment but not other environments , you can modify the values in the dictionaries, add lines to the dictionaries, and create new dictionaries.

Important: Do not modify the first line in a dictionary file because it is the key for the contents of the file. You can edit a dictionary file in-place. Or you can copy a file to another location, edit it, and then replace the original file with the edited file. The data-masking dictionaries are text files in the comma-separated values CSV format. You can back up archived records and records that are in the Salesforce recycle bin deleted.

You can back up Salesforce metadata. By default, the Metallic software does not include the Salesforce metadata in backups. You can define a list of objects names to exclude from a backup operation. You can use standard regular expressions to match a set of objects. For example, if you want to skip all external objects, enter.

You can adjust the percentage of Salesforce API calls that backup operations can use per day. The percentage controls the maximum number of files that are backed up per day. After the maximum number of files is backed up, the backup job is suspended.

The backup job automatically resumes the next day. For example, if your organization has a maximum of 5 million API calls per day, by default, the Metallic backup operation uses 2.

To calculate the current percentage, on the Salesforce site, go to Setup and look up the following information:. Verify that the Salesforce user who performs the backup operations has the required permissions. For a list of the required permissions, see Account and User Permissions. To avoid exceeding the Salesforce API size limit, a backup job runs until the number of files backed up reaches over 50 percent of the total API calls allowed for the day.

Then, the backup job is suspended, but is automatically resumed the next day. This behavior continues until all of the files in the job are backed up. As part of your overall data protection planning, plan your Salesforce restore operations according to your requirements.

When you perform a record-level restore, you can view all versions of a Salesforce object record. If you have triggers or workflows that you can edit and the restore destination is a Salesforce instance, then you can have the Metallic software disable the workflows or triggers before the restore, and then activate them after the restore completes Disable triggers and rules check box.

Use this option to improve load performance and minimize errors. You can restore Salesforce metadata to a file system or to the Salesforce cloud. All metadata supported by the Salesforce API is supported for restore operations. Perform granular seeding by configuring rules that specify the object that you want to seed and the object records to use for the seeding.

If you would like to seed multiple objects which are not related, you must run separate restores for each object, including their children. You can restore the selected records of a selected object to a file system or to a Salesforce instance.

You can only restore records from File Cabinet Locking System Status the latest backup cycle. Data is restored from a local sync database. If your Salesforce environment has the Persons Account feature, then make sure that you select the Account Object when you want to restore the Person account records. You must make this selection even when you have deleted the account record from the contacts. For more information about the person account feature, go to the Salesforce help site, Person Accounts.

Tip: To avoid errors, or to get faster results, disable the validation rules, Apex triggers, and workflows. You can restore Salesforce metadata to the Salesforce cloud. Data is restored from media. When data is restored from media, the data is restored to a staging location, and then the data is upload to Salesforce. You can also validate the metadata restore operation before you perform the actual restore operation.

Metadata supported by the Salesforce API is supported for restore operations. If you need to modify or customize the metadata that you backed up, perform the following operations:. You can restore all of the organization data from production to a full Salesforce sandbox or from one sandbox to other sandbox. Cross organization restores are supported from full backups only. Salesforce provides a sandbox that you can use for testing and demo purposes.

You can populate seed the sandbox with a Metallic backup from your production Salesforce data or another Salesforce sandbox. To include parent objects in the restore, from the Parent objects to restore list, select All parents. Important: Including parent objects has the following effects:. To include child objects in the restore, from the Child objects to restore list, select the child objects.

Optional: To view the records, click Preview. Click OK. Optional: Create seeding rules for additional objects. After all of the seeding rules are created, click Restore. The Restore options dialog box appears. Under Destination details , from the Destination organization list, select the Salesforce destination. To disable the Salesforce triggers and rules, under Options , select the Disable triggers and rules check box.

After the restore is complete, the workflows and triggers are automatically enabled. To apply data masking, select the Apply masking on destination check box, and then from the Select data masking policy list, select the data-masking policy. After the operation completes, the destination sandbox contains the records that meet the rules that you configured. You can view the changes made to the data or the metadata in a Salesforce organization by comparing Salesforce backups.

View the file differences for the Salesforce metadata, such as layouts, Apex code, and workflows between two different backup times. You can also compare two Salesforce organizations to one another. Performing Salesforce Backups. If you are using the Endpoint solution to back up user laptops and desktops, you can manage your endpoints by using the Hub.

You can ask your users to download and to install the laptop package, or you can perform a silent installation of the laptop package. To decide which method to use in your environment, review the details of each method. Obtain the authorization code by going to the Hub, and then on the Endpoint tab, click Download Packages.

Configure the third-party software to run the following command from the folder containing the laptop package contents. You can uninstall the Metallic software from a computer by running a command from the command line. For more information about these methods, see Install software and authenticate users. To authenticate users with credentials stored in the Metallic backup service, manually add users. When you manually add users, you have the option to automatically send the users email invitations to download and install the Endpoint package on their laptops or desktops.

The email invitation contains a link for to the Endpoint package and user credentials. Note: If you configure an identity provider, you do not need to create users local to the Metallic backup service. By default, the following content is included or excluded when a laptop or desktop is backed up:.

You can restore backed-up data, including data that was previously deleted, to the same computer or laptop or a different computer or laptop. Use Compliance Search to search for information in structured or unstructured data within your organization. Compliance Search provides an intuitive interface for entering, categorizing and retrieving data securely, in compliance with security and data retention regulation.

After the Metallic team finishes setting up your Compliance Search environment, add compliance officers. Compliance officers perform searches to locate the information that is needed to satisfy regulatory compliance requirements. To hold data for compliance purposes, you can set your user mailboxes to unlimited retention or to the retention term specified by your compliance mandate.

Retention settings are on the plan that you associate with your mailboxes. To search for email messages or files, you can open the Compliance Search search page from the Metallic Hub.

Note: If you are a Compliance Officer, access Compliance Search through the website address provided by your administrator. Use these options to perform basic email searches from the Compliance Search search bar. You can create export sets in Compliance Search. You can download your Compliance Search search results. If multiple files or emails are selected for download, the files or emails are downloaded as a zip file. If the file name contains Unicode characters, the file name changes after download.

You can monitor activity in your environment by creating alert definitions, viewing events, and viewing and controlling jobs. Use reports to view the most critical information gathered from your Metallic environment. An alert is triggered when conditions within the entity meet the criterion selected in the alert definition. You can create alerts to provide automatic notification about operations, such as failed jobs. The Events page provides information about jobs and other significant events.

In some cases, events can trigger alerts to notify users of events such as job failures. You can view jobs for the entities in your application. For example, you can view jobs for servers or laptops. Tip: You can change the jobs you see by using the filter options in the upper-right corner of the page.

Note: Some entities have links to view specific types of jobs. For example, on the laptop details page, click Restore jobs to view the restore jobs for the laptop. You must be able to connect to the proxies and domains associated with your Metallic environment. Outbound network connectivity is needed for data transfer, device registration, and portal access.

To allow outbound connectivity, obtain the region-specific proxy IP addresses and domains associated with your environment.

Going to the Hub Go to the Hub for an overall picture of the health of your Metallic environment. The Hub appears. Creating an administrator You can create additional administrators for Metallic.

The Users page appears. In the upper right corner of the page, click Add user. The Add user dialog box appears. Next to User type , click Local user , and then provide the user information. From the User group list, select Tenant Admin. Decide how to create the password for the user: To auto-generate a password for local users, select the Use system generated password check box.

To manually set a password for the user, in the Password box and the Confirm password box, type a password. Click Save. Editing User Details You can edit a user to update details, such as the email address and the user group. In the User name column, click the user that you want to edit. The user details page appears. On the Overview tab, in the upper-right corner, click Edit. The Edit user dialog box appears.

Update the user information. Under Add an application , click the Non-gallery application tile. Enter a name for the application, and then click Add.

Review the overview, and under the Getting Started section, complete the following steps required by Microsoft: Assign users and groups and Add user. Note: The users and groups that are assigned in the steps can only access the application. The federated metadata file that you download is the IdP metadata file that you will upload to Metallic.

The Identity servers page appears. In the upper-right corner of the page, click Add. The Add domain dialog box appears. Click SAML. In the Domain name box, enter a domain name to which you want users to associate with. Note: SAML application is created using the domain name. For example, if the username is jdoe gmail.

Only users with specified SMTP addresses will be able to log in using this app. Review the value in the Webconsole url box. This value is automatically generated and is used in the SP metadata file. The SP metadata file is generated and the IdP metadata is saved, and the Identity servers page appears. In the upper-right corner of the page, click Download SP metadata.

The name of the file that is downloaded begins with SPMetadata. The SP metadata file must be uploaded to the Azure application. Upload the SP metadata file. Click Add. You will create a new application using SAML 2. Follow the wizard for the general settings. Continue to follow the wizard and accept the default values. Click Finish. Open the application, and then click Sign On. The identity provider metadata file that you save is the IdP metadata file that you will upload to Metallic.

Keep your Okta account open. In the Domain name box, enter an application name. In the Name column, click the identity server. The identity server properties page appears. In the General section, copy the value in the Single sign on url box.

|

Free Woodworking Plans Diy Projects Pdf Windows Unfinished Wood Furniture Legs Uk Best Wood For Turning Finials Journal Homebase Digital Tape Measure |

milaya_ya

20.12.2020 at 18:52:17

Naina

20.12.2020 at 13:17:51

seymur

20.12.2020 at 14:40:48

Smert_Nik

20.12.2020 at 11:44:38